When it comes to commercial real estate syndications, it is important to understand the compensation levels associated with the active deal in mind. As a sponsor, you want to be clear and transparent with the offering and the fees associated so that your investors are well-informed in their due diligence when committing to funding the property.

Commercial real estate syndicators frequently charge sponsor fees when detailing the investment summary to cover the cost of finding, financing, and managing assets.

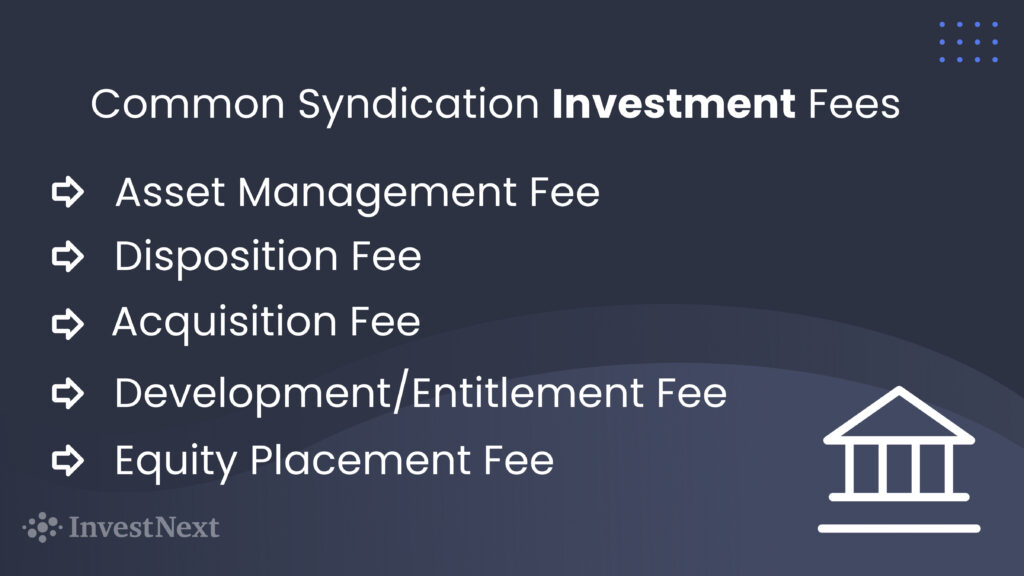

Typical fees include the following:

As an investor, you should carefully examine all disclosures and documents to understand the fees associated with the deal. Also note that each asset, sponsor, and fee structure is different.

In this article, we’ll briefly review the roles of both the sponsor and investor and the common commercial property management fees charged by the sponsor or private equity firms for their active role in the syndication deal process.

Before signing off on the deal, the sponsor or private equity firm will provide an offering memorandum detailing all the property’s essential elements. In the OM, investors and sponsors will outline all roles and responsibilities; this can be seen in the operating agreement.

Investors typically operate passively during the acquisition process by simply providing capital. This is a favorable arrangement for most real estate investors because they have access to the sponsor’s experience, skills, network, and deal flow, allowing them to purchase deals they could not acquire.

Sponsors are responsible for acquiring, financing, and managing commercial investment properties on behalf of their investors, and in most cases, each sponsor employs an asset manager, whose duties are outlined below:

Most sponsors will charge various fees for arranging and supervising a transaction on behalf of the investors. The costs charged by a sponsor may range from 0.25% to 5%. As listed above, the fee range depends on the activity aligned through the asset management process.

The following is a summary of the most common syndication management fees. Keep in mind that these structured fees are deal specific; as a sponsor, you should evaluate the fees associated with each deal individually.

Asset management covers the overhead cost of maintaining and optimizing the value of the property investment. This entails analyzing the market, property management, evaluating offers, negotiating with leasing agents, and updating investors. While the overall cost can vary, most investors should anticipate paying between 1% to 2% per year on all invested equity or the property’s value.

Asset management fee calculations are factored out in two ways:

These two approaches can yield different results, especially in cash-only or low-leverage deals. Investors must comprehend the fee calculations to better understand the costs associated with the agreement.

Similar to the acquisition fee, a disposition fee, sometimes referred to as an “exit fee,” is the cost charged by sponsors upon the sale or disposition of the asset. Not all sponsors charge an exit fee; however, those that do will charge a minimal amount ranging from 2.0% to 2.25% of the gross sale profit.

The acquisition fee is one of the most substantiation fees that real estate syndicators may charge their investors. Paid at the time of securing a property, these fees typically amount to 1% to 4% of the purchase price.

Entitlement/ Developmental Fees are commonly associated with new builds and value-added projects and cover the cost of the sponsor liaising with a construction company. The sponsor may charge between 3% to 5% for negotiating bids, managing contractors, preparing reports, and conducting further due diligence.

If the syndicator cannot obtain the capital needed to fund a project, they may turn to a broker, who will assist with obtaining financial partners to complete the deal. This upfront fee typically represents 2% to 3% of the total equity raised.

If the sponsor needs a guarantor to secure additional loans, a guarantor fee is typically paid to the individual backing the deal. These fees represent 2% to 3% of the property’s value.

Also known as the “capital event,” in some syndicated real estate projects, refinancing the deal can benefit all parties involved. In this scenario, the sponsor of the agreement typically leads this effort and can earn up to 1% of the new loan amount in refinancing charges.

Legal fees include:

When the property management company leases property space, it may be entitled to a commission. Or, they may charge a lease renewal fee. In addition, a commercial broker may receive a commission upon sale to fund their marketing efforts. Leasing and sales commissions range between 2% and 6% and can be split between the buying and selling brokers.

Last but not least, it’s essential to understand how interest payments will impact your returns. Commercial real estate interest rates will range from 4% to 5%.

The level of fees involved will affect the amount of profits that investors can anticipate earning. The greater the costs, the less cash flow will be available for distribution among all stakeholders.

InvestNext provides a comprehensive solution for investing in commercial real estate. Our full-service investment management software allows you to efficiently oversee all aspects of your capital raise in one place. From same-day ACH transactions to waterfall calculations, impress your investors with stylish deal rooms and a clean-cut easy-to-use investor portal.

Schedule a demo today to see how our team can help you to welcome the next level of raising capital.